Africa: Foreign Investment and Human Rights Issues

Africa is one of the world’s regions in which foreign investors have had significant impacts, including the neglect of human rights and the support of corruption. Various African resources, including oil and minerals are mostly dealt with by multinational companies, entering into agreement with African governments.

Investment is critical for developing countries since it contributes to the industrial development while providing a unique combination of long-term finance, technology, training, technical know-how, managerial expertise, and marketing experience (Gochero & Boopen, 2020). Many countries are seeking ways to increase investment. Sometimes, regimes use access to external financial resources to develop their power and longevity (Kishi et al., 2017).

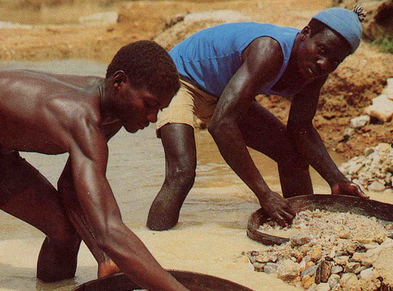

Africa is one of the world’s regions in which foreign investors have had significant impacts, including the neglect of human rights and the support of corruption (Corkin, 2011; Shin, Lin, Li, & Zeng, 2018). Investment is undoubtedly vital for African states to develop and achieve positive economic as well as social changes. However, there exists obstacles to peaceful and prosperous development for both states and citizens, leading to the experience of poverty among many people across the African nations even after independence. Various African resources, including oil and minerals are mostly dealt with by multinational companies, entering into agreement with African governments (African Development Bank, 2018). In many cases, lack of oversight and policy transparency leads to the loss of wealth and treasures by the Africans. Such looting of the treasure is still going on the different nations of Africa, particularly in oil and mineral rich regions (Nnajiofor, 2019). Although these obstacles can be mitigated with oversight and public transparency, without conditions, oversight, and monitoring of the state tactics and investor behavior, African states risk investing in violence instead of the establishment of a context in which citizens and future governments can benefit from the possibilities and promise of investment. According to the South African Human Rights Commission (2020), although private sector companies know about their human rights responsibilities and may be held responsible for the violations of human rights at some point, there are several factors that contribute to failure to observe human rights in investments some of which are as follows:

– The rules and principles seem primarily to be only a paper exercise which means failure to follow them through investors’ commitment. In other words, when strong state regulations are absent or there are no monitoring legislations and policies, the investors do not feel any serious obligations to show responsibility. Accordingly, there is no hesitation to violate rights when there is an opportunity.

– The issue of human rights responsibility loses its real value and becomes a check-box exercise or something which merely seems good on annual reports or websites. When there is no adequate remedy to address the victims’ rights effectively and according to the international human rights law, there is less motivation to struggle and seek to attain such rights.

– Failure to provide the required tangible mechanisms which can facilitate the enforcement of human rights of the victim nations is another challenge in the nations under investors’ exploitation.

– The victims may experience different obstacles in accessing efficient remedies for the violation of human rights, such as juridical or practical barriers at the national and extraterritorial levels. Such problems are particularly observed in conditions that victims are not regarded the holders of the rights, deserving attention as those who have a significant role to play in the businesses within their national context.

As Nnajifor (2019) has quoted from Clinton (2011), it is easy to enter a nation, exploit natural resources, pay off leaders, and then leave, after which there is not much left behind for the people who are there. There are no improvements of the standards of living and no opportunities to promote. However, according to South African Commission (2020), Africa needs a particular treaty body as it is experiencing systematic abuses and human rights violations by private businesses. State corruption also facilitates these human rights violations, and special mechanisms are required to address such corruption. Ultimately, investment agreements should explicitly consider the human rights obligations and best practice at both national and international levels and ensure adherence to human rights law.

References

Africa Development Bank, “Resource companies ripping-off Africa”-AFDB Chief. Available at http://uk.reuters.com/Art./2013/06/16/uk-africa-economy-idUKBRE95F0EH20130616 [Accessed on 3/10/2018].

Corkin, L. (2011). Uneasy allies: China’s evolving relations with Angola. Journal of contemporary African Studies, 29(2), 169-180.

Gochero, P., & Boopen, S. (2020). The effect of mining foreign direct investment inflow on the economic growth of Zimbabwe. Journal of Economic Structures, 9(1), 1-17.

Kishi R., Maggio G. & Raleigh C. (2017). Foreign Investment and State Conflicts in Africa, Peace Economics, Peace Science, and Public Policy. De Gruyter, vol. 23(3), pages 1-22, August.

Nnajiofor, P. (2020). Chinese and Western Investments in Africa: A Comparative Analysis. International Critical Thought, 1-10.

Shan, S., Lin, Z., Yulei, L., & Zeng, Y. (2018). Attracting Chinese FDI in Africa: The Role of Natural Resources, Market Size and Institutional Quality. Critical Perspectives on International Business, 14(2-3), 139-153.

South African Human Rights Commission. (2020). Response to Call for Input: UNGPs 10+ / Next decade of business and human rights action. Retrieved from https://www.ohchr.org/Documents/Issues/Business/UNGPsBHRnext10/inputs/nhris/south-african-commission.pdf